are electric cars tax deductible uk

You lease an electric car for 6000 over the 2022-23 financial year. After the first year any cars that produce at least 1gkm of CO2 will have to pay 145 per year but if your car is.

Electric Company Car Tax Explained Guides Driveelectric

While it was often much more tax-efficient to run a car privately and claim business mileage in the past the generous company and personal tax benefits can make going electric an excellent option.

. Electric vehicles The electricity must come from an external source or an electric storage battery not connected to. Like pure electric cars with no exhaust emissions company car drivers will benefit from zero BIK tax from April 6 2020 rising to one per cent and two per cent in subsequent years. Before this date electric vehicles costing more than 40000 were liable for an annual road-tax surcharge the first five times the tax was renewed.

Tax relief for electric car charging. For the employee there will be less income taxNIC to pay. Summary of Electric Car Tax Benefits In his March 2020 Budget Chancellor of the Exchequer Rishi Sunak confirmed that motorists buying electric cars would continue to benefit from the Plug-In Car Grant to 2022-2023 but it would reduce from 3500 to 3000 and cars costing 50000 or more would be excluded.

Electric cars will incur no benefit-in-kind tax for the 2020-21 tax year. Read more on UK road rules. These will be deductible expenses for Corporation Tax.

The rules were changed again in April 2020 albeit to a lesser degree. After the first year a standard rate applies to all cars with three core exceptions. New Cars For Sale Near Me.

With more than two-thirds of electric vehicles in the UK being registered to businesses. Do electric cars pay road tax in the UK. The proportion you can claim depends on how much business use your car gets.

For the employer the main advantage is the NIC saving. This charge is deductible for corporation tax purposes. If the driver charges the car at home there would have been a VAT charge of 5.

The tax rules around running an electric car in a Limited Company now mean that running a company car can be an excellent option for the owners or employees of a limited company. The excise tax rate for all types of tobacco cigarettes raw tobacco and tobacco waste as well as the minimum. You can also check if your employee is eligible for tax relief.

You deduct the cost against profits. In addition if you allow your employees to charge electric vehicles at your workplace for free this does not count as a taxable benefit in kind for P11D purposes. This electric car tax relief will increase to 1 in 2021 and 2 in 2022 helping businesses to forward-plan their finances.

Are electric cars tax-deductible in the UK. The equivalent electric car will cost a lower tax payer 1086 and a higher tax payer 2173 in the current tax year 1920. Rates increase slightly thereafter.

Unlike a combustion engine car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre-tax profits which reduces their tax. If the car is a hybrid. Yes electric car subscriptions are tax deductible in the UK.

Other benefits to leasing include not having to worry about depreciation fixed assets and capital allowances. As corporation tax is 19 then your tax savings are calculated as 19 x 6000 1140. For example a fully electric car that cost 50000 would give rise to a benefit in kind of 0 in 202021 with the exact amount changing each year.

Not only does a move to an electric car benefit the environment and reduce fuel costs but it could also provide you with potential tax savings in the year of purchase. Next year 20202021 this drops all the way to ZERO for electric cars. For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels.

In 20212022 and 20222023 the benefit in kind will increase to 1 and 2 respectively. However HMRC maintains that the supply of domestic power is to the individual and VAT is not deductible by the business. Therefore it could be argued that 121 of the 5p is VAT.

Buying a car through your business example As a higher rate taxpayer you buy a 50k VAT car through your business and you will be using it 5050 for business and personal use. Fully electric vehicles can still create substantial savings for both employees and employers when taken via salary sacrifice. There has always been a similar argument brought in an action.

A similarly priced top-of-the-range Nissan Leaf E attracts zero BIK this financial year 1 next and 2 the year after. Someone who took delivery of a new petrol-fuelled BMW 3-series company car 146gkm of CO2 last April is paying a benefit in kind BIK tax of 32 rising to 34 by 202223. But all electric cars are now exempt from all VED costs no matter their original list price.

You can claim for the capital cost of buying the vehicle as well as for other running costs such as insurance and repairs. If your business installs charging points for electric vehicles between now and 31 March 2023 100 first year allowances can be claimed on the investment cost. Zero emission cars will pay 0 whereas cars with CO2 emissions of 256gkm and over will be expected to pay 2135 for the first year.

With sustainability firmly on everyones agenda more and more individuals are looking at the benefits of electric cars including tax benefits. Its an incentive that aims to increase the number of electric vehicle registrations which rose considerably over the last year. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car.

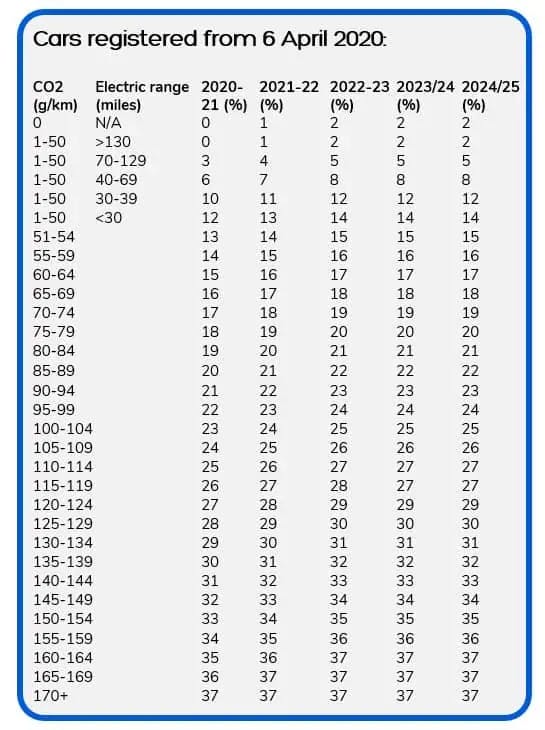

A premium rate is charged for years 2-6 for models costing more than 40000 when new whilst alternatively fuelled vehicles - including pure-electric plug-in hybrid and hybrid cars - qualify for a 10 Alternative Fuel Discount. However there have been significant reductions in this charge from April 2020 with electric-only cars falling to 0 in 2020-21 as well as reductions for electric hybrids depending on their electric-only range. Vehicles made before 1 January 1982 are exempt.

There are several apparent difficulties with electric cars.

The Tax Benefits Of Electric Vehicles Saffery Champness

A Guide To Company Car Tax For Electric Cars Clm

Electric Car Tax Relief Together Accounting

Can I Save Money With An Electric Car Times Money Mentor

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Road Tax Company Tax Benefits On Electric Cars Edf

Buying A Tesla Saved Me 15 500 In Tax Times Money Mentor

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

The Tax Benefits Of Electric Vehicles Saffery Champness

A Complete Guide To Ev Ev Charging Incentives In The Uk

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Road Tax Company Tax Benefits On Electric Cars Edf

Should I Buy An Electric Car Through My Business Tax Implications

Road Tax Company Tax Benefits On Electric Cars Edf

Tax Advantages On Electric Vehicles For Company Car Drivers Moore

Democrats Bill Would Allow Auto Dealers To Claim Clean Vehicle Tax Credits

The Electric Car Salary Sacrifice Tax Break That Can Save You 40 This Is Money

Electric Cars For Dentists Are Almost Tax Free With Their Own Company